are delinquent property taxes public record

All payments received may not be shown as of this date. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question.

How To Find Tax Delinquent Properties In Your Area Rethority

803 785-8345 Real Estate Taxes.

. Deadlines for Property Taxes Please check your delinquent. Delinquent tax records are handled differently by state. Personal checks will be accepted for payment of.

For questions visit Frequently Asked Questions. An owner whose property is subject. A tax lien is a legal claim against real property for unpaid municipal charges such as property taxes housing maintenance water sewer demolition etc.

Search Use the search critera below to begin searching for your record. Have not paid their taxes for at least 6 months from the day their taxes were assessed. Check to see if your taxes are past due.

Property tax is delinquent on April 1 and is subject to penalties and interest. Tax Record Search and Online Payments Spartanburg County Taxes pageDescription. Delinquent property tax cannot be paid online.

Have more than 25000 in total liabilities and. Citizens may pay their delinquent taxes at the Delinquent Tax Office 843- 479-5602 ext 11 located in the Marlboro County Courthouse. Once property taxes are in a delinquent status payment.

Tax and Scavenger Sales. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount. Delinquent payments must be received.

Finds and notifies taxpayers of taxes owed. Rock Island County Real Estate Taxes are. 105-3651 b 1.

Under Kansas law all unpaid real estate taxes commences a two year vacant lots and commercial property or three year residential property on the first Tuesday of each. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. Search Use the search critera below to begin searching for your record.

City of East Lansing Ingham County. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. Public Act 123 of 1999 shortens the amount of time property owners have to pay their delinquent taxes before losing their property.

For example property taxes that were due in 2020 and payable to the local City or Township will became delinquent on March 1 2021. The Delinquent Tax Division investigates and collects delinquent real and personal property taxes penalties and levy costs. Delinquent Tax Department Brett Finley Phone.

Due to a change in the statue participating jurisdictions may elect to turn over their delinquent business property taxes to their delinquent tax attorneys for collection on April 1st of the year. Delinquent Property Tax Deadline Approaching. Real Estate Property Taxes Due.

Delinquent Property Tax Search. In our ongoing effort to prevent residential and commercial property foreclosures Oakland County residents and business owners with unpaid. Delinquent Personal Property Online Payment Service.

City of Wayne Wayne County. Delinquent Personal Property Online Payment Service. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

If the real estate property taxes on a parcel are not paid they become delinquent.

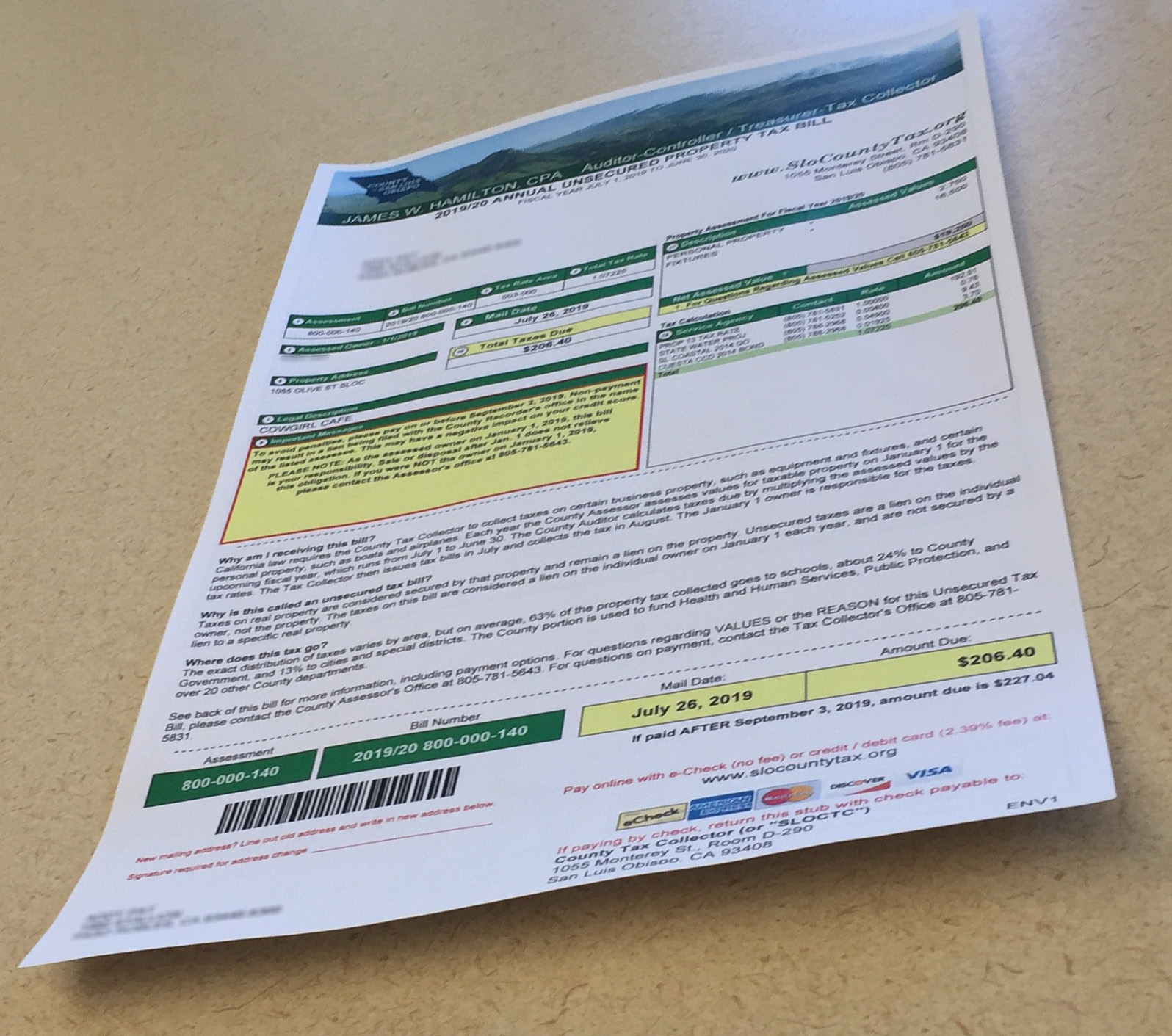

Tax Collector County Of San Luis Obispo

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

How To Find Tax Delinquent Properties In Your Area Rethority

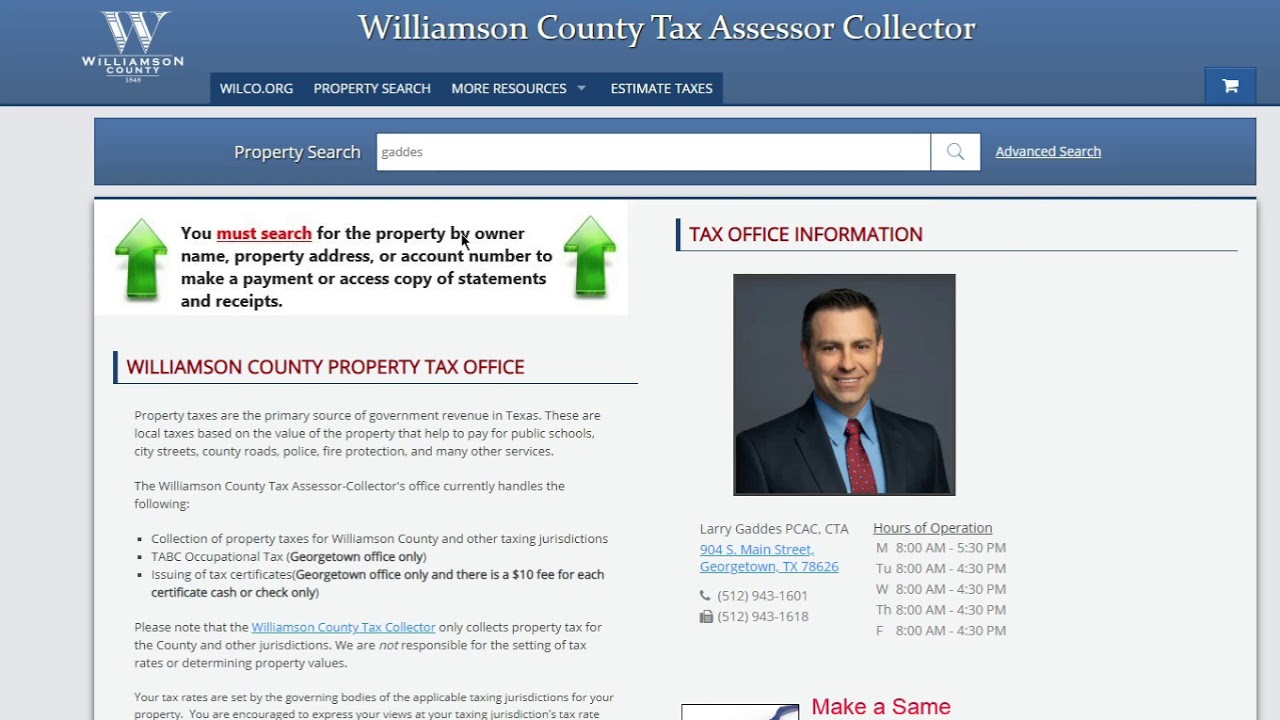

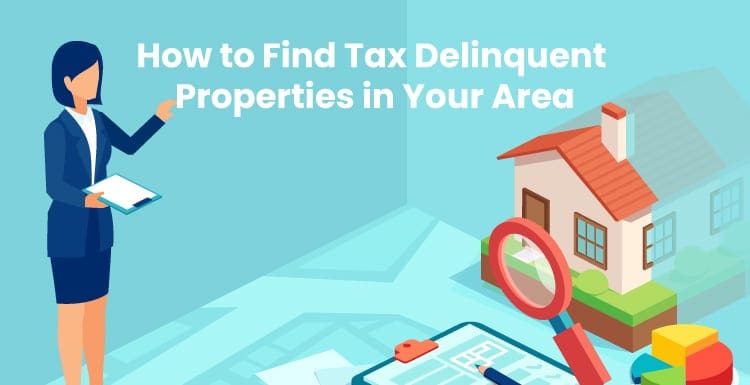

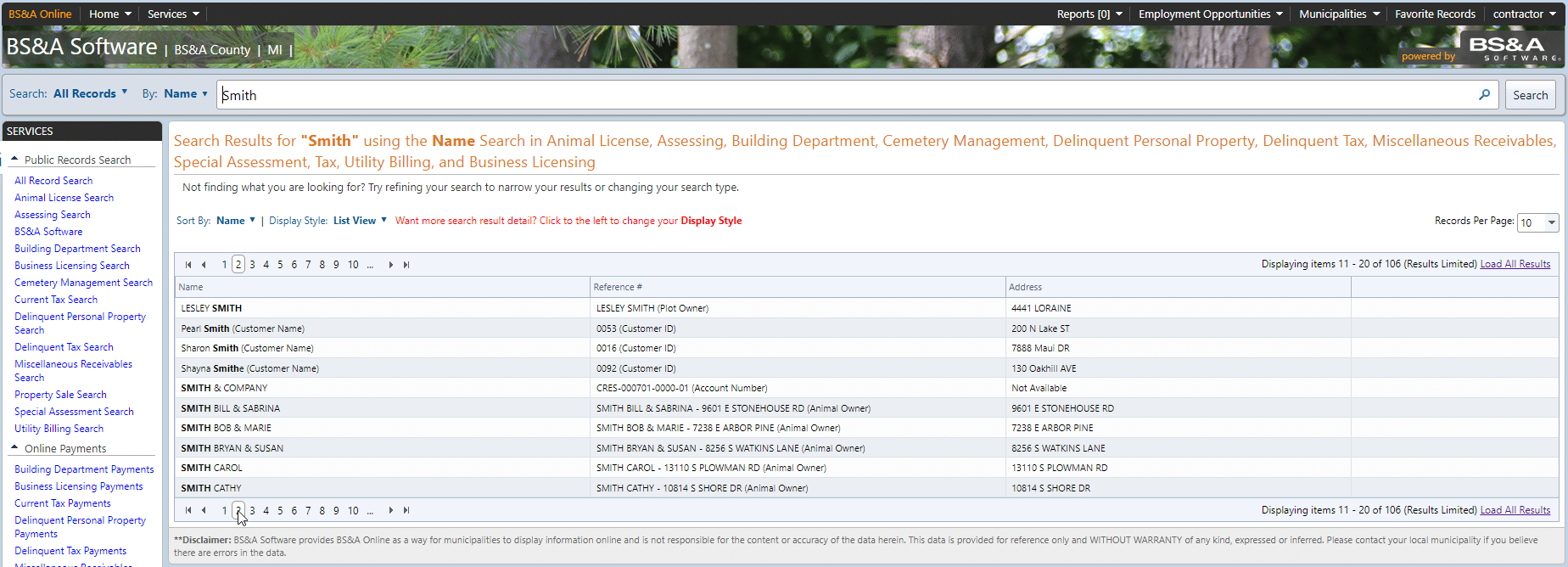

Bs A Online Services Public Records Search Bs A Software

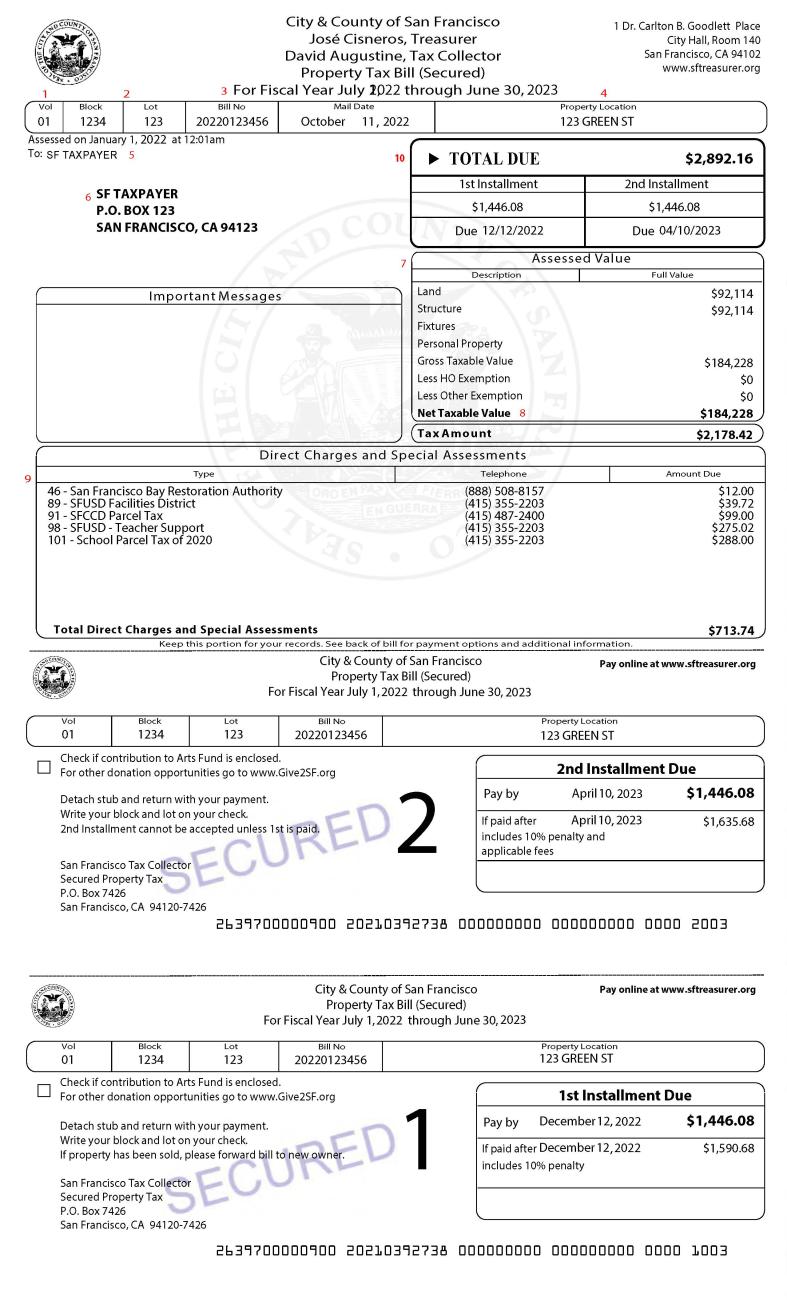

Secured Property Taxes Treasurer Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

Investing In Property Tax Liens

Tax Collector County Of San Luis Obispo

Delinquent Property Tax Owners Will Be Listed In The Charlotte Observer

Is California A Tax Deed State And How Do You Find A Tax Sale There

Charlotte County Tax Collector Delinquent Taxes

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Office Of The State Tax Sale Ombudsman

Real Estate Property Tax Constitutional Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal