how to avoid tax on 457 withdrawal

Colorful interactive simply The Best Financial Calculators. DCP is comprised of two.

A Guide To 457 B Retirement Plans Smartasset

Like most retirement accounts the IRS imposes limits on how much can be contributed annually.

. Contributions to these funds are made by workers before taxes and withdrawals are subject to taxation much as 401 ks. In 2020 and 2021 the maximum annual contribution to a SIMPLE. All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates.

The amount you wish to withdraw from your qualified retirement plan. However if you withdraw from. Withdrawals are subject to income tax.

This means you wont pay any taxes. The New York City Deferred Compensation Plan DCP allows eligible New York City employees a way to save for retirement through convenient payroll deductions. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old.

457 Plan Withdrawal Calculator. Withdrawals are subject to income tax. Tax-deferred retirement accounts such as a 401k or traditional IRA are funded with pre-tax dollars.

The amount you wish to withdraw from your qualified retirement plan. In addition to any taxes you owe on your withdrawal you will owe an additional 10. Here is a list of the key rules.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. The early withdrawal penalty is a 10 penalty.

Get a 457 Plan Withdrawal Calculator branded for your website. Withdrawing money from a. When Can You Withdraw From a 457 Deferred Compensation.

457 plans are non-qualified deferred-compensation plans offered to employees. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Contributions accumulate on a tax-deferred basis until distributed or for 457f plans when the employee is fully vested.

For this calculation we assume that all contributions to the retirement account. Can you withdraw money from a 457 B plan. 16 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement plan be.

Generally the amounts an individual withdraws from an IRA or retirement plan before. Move on to Tax-Deferred Accounts. The ability to avoid the early withdrawal penalty if.

For this calculation we assume that all contributions to the retirement account. So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans. However wit See more.

If you have a 457 b you can withdraw the budget from your account without any early withdrawal penalty. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457.

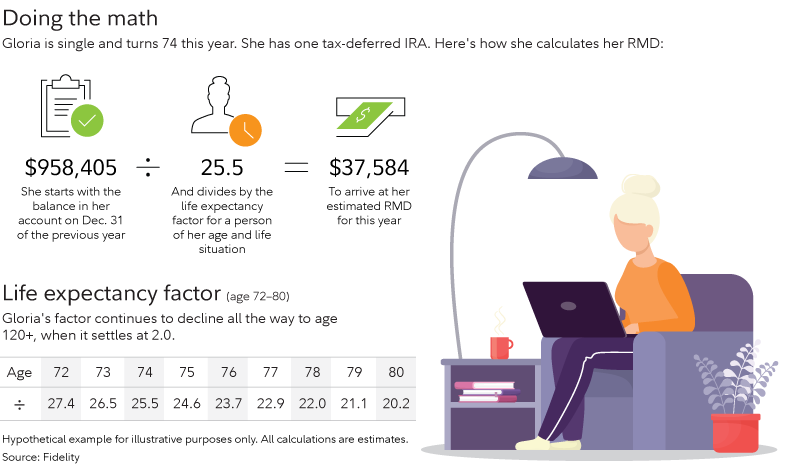

Required Minimum Distributions Rmds Rules And Strategies Fidelity

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

A Guide To 457 B Retirement Plans Smartasset

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

A Guide To 457 B Retirement Plans Smartasset

:max_bytes(150000):strip_icc()/GettyImages-1353850562-5a09f8cd494ec9003739b86b.jpg)

Are 457 Plan Withdrawals Taxable

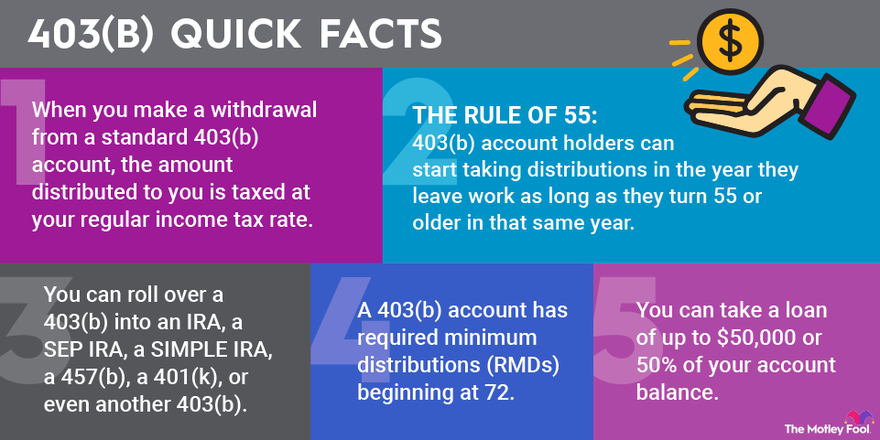

403 B Plan How It Works And Pros Cons The Motley Fool

Iras Avoid Double Taxation On Withdrawals 08 01 16 Skloff Financial Group

457 B Retirement Plans Here S How They Work Bankrate

The Cost Of Cashing Out Retirement Plans Early Equitable

How Much Tax Do I Pay On 401k Withdrawal

How A 457 Plan Works After Retirement

How To Pay Less Tax On Retirement Account Withdrawals

457 Deferred Compensation Plan White Coat Investor

457 Deferred Compensation Plan White Coat Investor

457 Vs Roth Ira What You Should Know 2022